The background

To start, why?

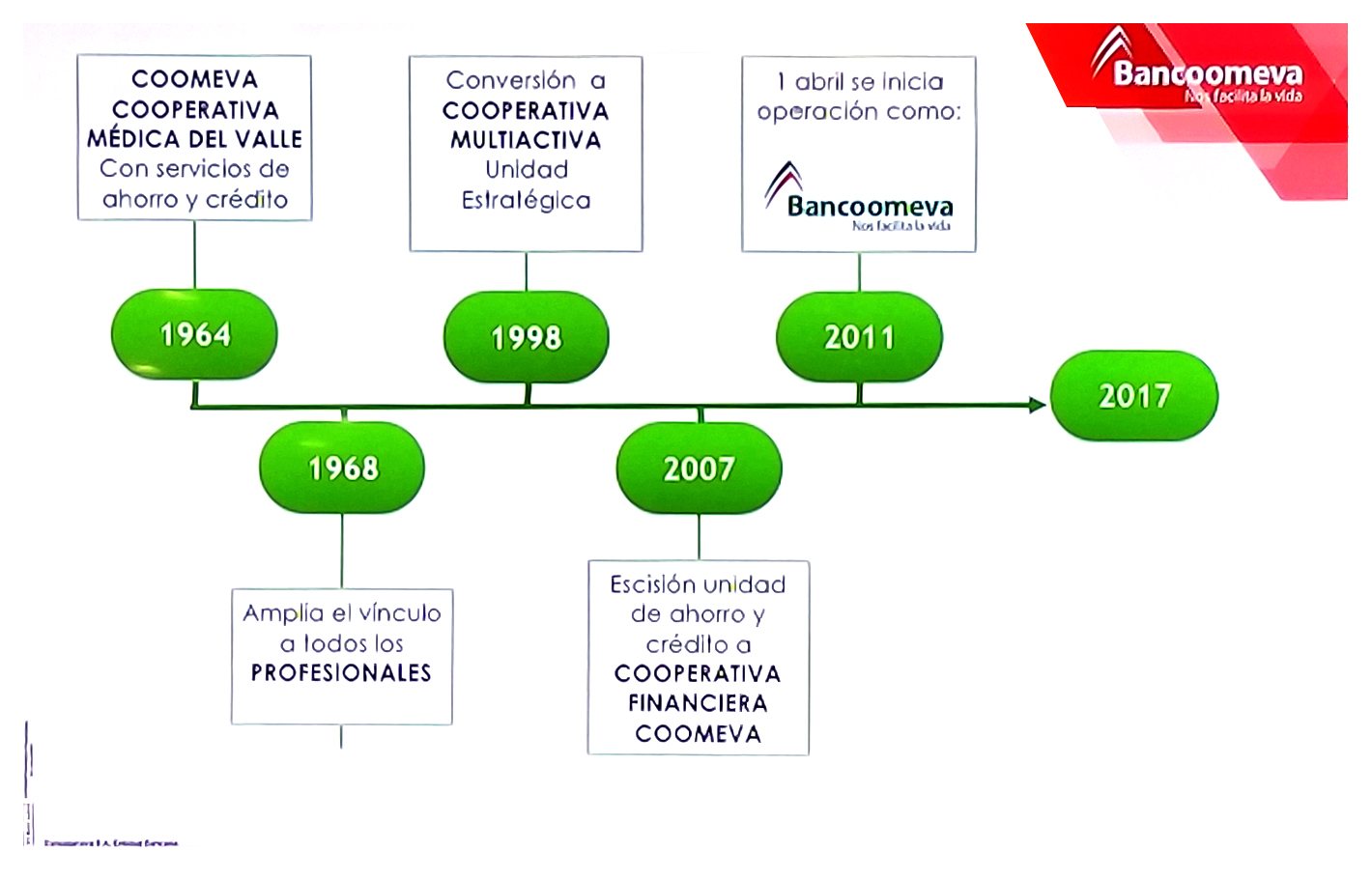

Bancoomeva is a financial institution supported by the Cooperative Enterprise Group Coomeva, associating 16 companies in various productive sectors with operations in Colombia for over 50 years and whose primary objective is to provide financial services to all Group partners. Amii is a service design project in the Master in Innovation Management at Icesi University.

The challenge

Understanding business needs

Create a financial service tailored to the needs of millennials, increasing the young people growing purchasing power using the Bank’s services.

At the end of the process, we expect a product or service technology-based with a high degree of differentiation that can be implemented in the short or medium term. We must deliver a service concept, prototypes, documentation, a canvas model, and a work plan.

The research

Defining the needs and pain points

Our fieldwork begins with finding information about the industry through qualitative and quantitative research to understand the current state of the business regarding service and banking products for young people. At this stage, we seek to develop activities that help us know how the company works and how the Bank interacts with its customers.

We started with a trend analysis of the banking sector and benchmarks of national and international banks that already had some service for our target audience.

The process

Digging for innovation

We interviewed 20 young millennials to gather their inner experiences, anecdotes, and disagreements when using a banking service.

Then we did five semi-structured interviews with bank leaders to learn how Bancoomeva operates.

On the other hand, we did three dives via Service Safari in different branches of the Bank in the city.

With these dives we:

• Measure the time to attend to the request.

• Note the moods of the millennial while visiting the branch.

• Measure the effectiveness of the response to the request.

• Observe the empathy of bank officials when attending to youth less than 27 years.

• Detect faults and customers’ pain points using channels in the Bank.

The discover

What did we find?

Most millennials begin their process of banking with the Bank that their parents recommend or where they create the account in their first job.

Going to a bank to stand in line is a punishment and it will always be my last option. Time is my most precious asset

millennial, 25 age

They feel that banking services are not unified across all channels. Therefore, they cannot initiate a transaction on the website and then finish from the app.

Millennials do not want banks to call them; they want the Bank to be there when needed.

We did a focus group with five young millennials where they narrated their experience about how they interact with their current banks. The main pain points were: timeout, the documentation required for each product, and being called to offer some other service.

We did the same exercise with millennials who already use Bancoomeva, and the experience was not significantly different. We do recognize that this Bank has some features in its much better than the competition app.

According to their age, they have different consumer expectations; the younger ones have short-term goals and believe that 100-300 USD is a lot of money, while the older ones have long-term goals and need large amounts of cash to meet them.

The customers

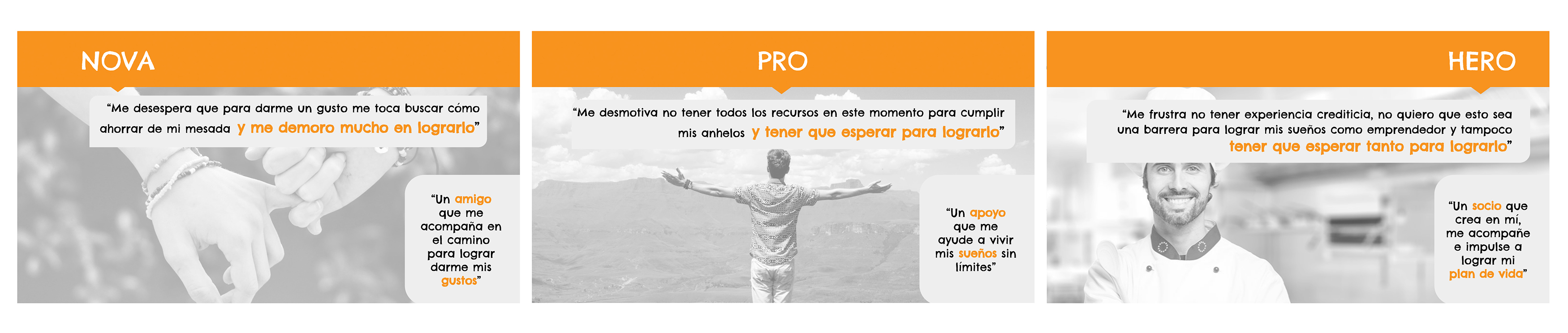

Therefore, it was necessary to classify users by age and salary range, understanding that each segment needed a different bank product.

We took their central insights for each customer segment and proposed an initial service concept. Additionally, they were assigned a hashtag to identify them until we could decide which one we would finally work on.

Some insights

After an exercise of co-creation and using low-fidelity prototypes with users, we found the following expectations: they expect the Bank to be that friend to help them meet their goals and seek a more enjoyable communication bank language.

In each user profile, we selected the central pain and created a phrase that will allow us to tell the Bank what their millennial users seek:

Our challenge

With previous findings and the definition of customers, we decided to create a challenging question that would allow us to respond to the initial problem of the Bank.

The service concept

Creating opportunities

We present to the Bancoomeva managers three concepts of service, their main features, and a prototype for each proposal.

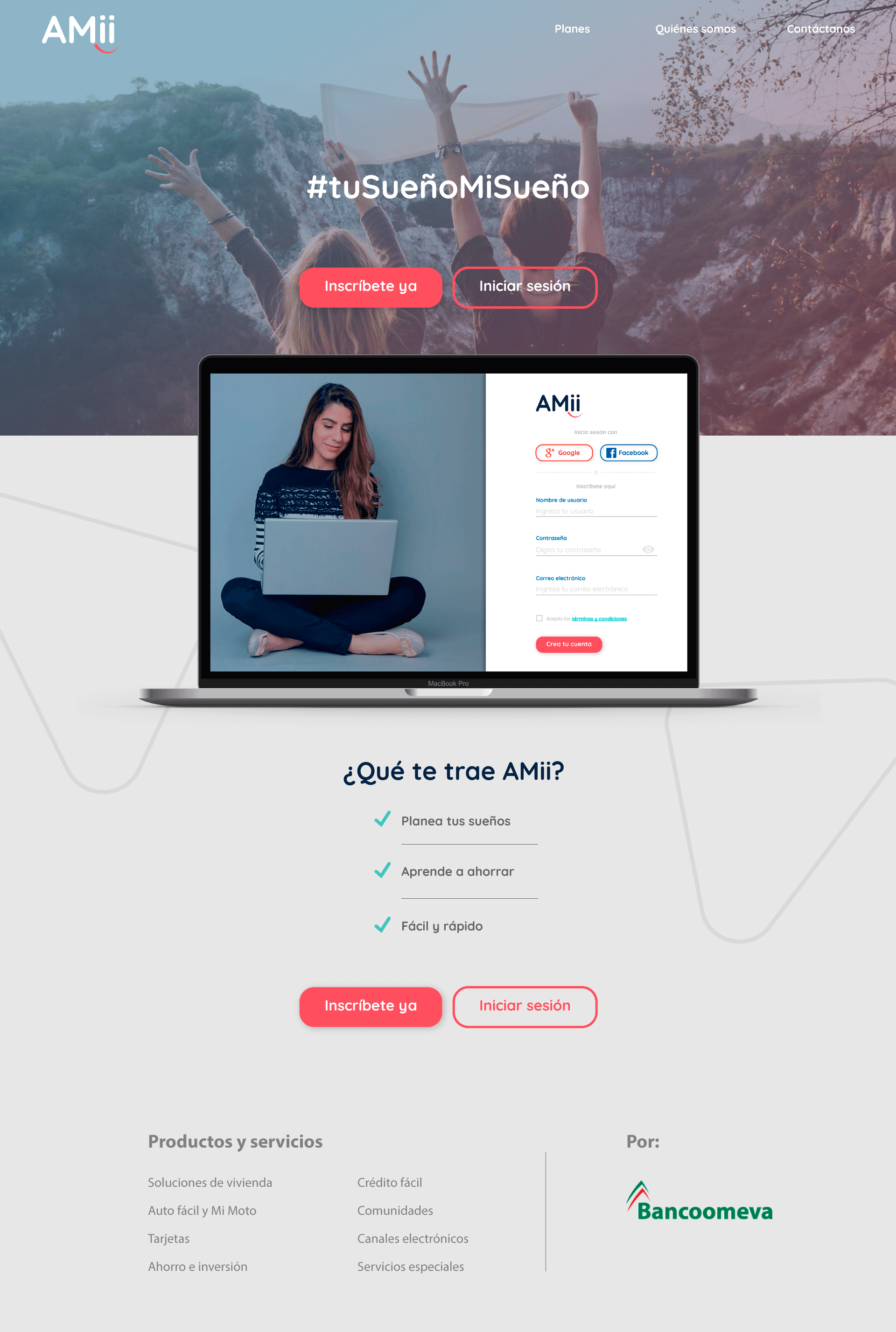

The Bank should select the service concept that best meets their expectations, which we will work on over the next month. The winning proposal was #tusueñomisueño. From that moment, we started to develop this service in depth.

Delivery

Tu sueño mi sueño

It is a service that allows me to give the Bank my dreams or projects so they can help me design the best route to achieve this. #tusueñomisueño proposes periodic actions in the desired accompaniment of a virtual advisor time.

This service is based on friendship, with friendly language and digital processes. So we proposed creating a young brand with a new identity to attend our user segment and not interfere with the Bank’s current scheme of corporate clients.

Amii is a service that lets me enter a dream with an estimated achievement date; with this service, I can make regular savings individually or invite my group of friends or family to join the goal; the platform has a virtual advisor with that I can apply for financial services without having to go to a physical branch office.

Boom !!!

The results

The Bank represents an improvement in the collection of outstanding portfolios, decreasing their user service times, streamlining the delivery process of financial products, increasing the use of digital channels, and lowering the cost of customer acquisition.

For the millennials, it was a relief to report that they could not make the next payment for their services; they used the freeze of quota to avoid obtaining a negative score in the Colombian financial system.

* Privacy regulations cannot expose other functionalities and results of the process.

This project was accomplished in 10 weeks.

The team

José David – MBA, Entrepreneur consultant

Nathalia Ramirez – Trade Marketing

David Portilla – UX / Product designer

Marcela Franco – Vicepresident Assistant of Bancoomeva

Laura Oggioni – Interactive Media Design Student